Why is Griffith’s Valuation Important?

The purpose of Griffith’s Valuation was to determine the value of land and buildings held privately in the country and to set a rental rate for each property. It was not a census, but it has become extremely important to those conducting genealogical research and for historians because of the loss of previous census records from 1821 to 1891.

The records for 1821, 1831 and 1841, except for those from a few counties in 1821 and 1831, were destroyed by fire at the Public Record Office within the first two days of the Civil War. The original census returns for 1861 and 1871 were destroyed shortly after the census was taken. The census returns for 1881 and 1891 were destroyed during World War 1 when they were pulped, possibly due to a paper shortage.

These losses leave Griffith’s Valuation as the most comprehensive 19th century record of where people lived and the property they owned or leased. Griffith’s Valuation also included map reference numbers that can help locate property on OSI maps.

Griffith's Valuation for the Ballyoughter Area

In the first document below are the transcribed/extracted pages from Griffith’s Valuations of County Wexford 1853. On these pages, you can view the townlands, its occupiers, immediate lessors, details of the tenements with area and valuations for both land and buildings. You may be able to trace your family’s existence in the area and the exact location of where they lived using the letters of reference (in column 1 of the records) along with the associated Griffith’s maps.

In the second document below are the original records as hand-written at the time of valuation.

If you’re not familiar with the history of the Griffith’s Valuation, please read the article, ‘Griffith’s Valuation Explained’, below so you can analyse the valuations and interpret the maps correctly.

Extract pages and original book pages from Griffith’s Valuation of County Wexford 1853 showing the Townlands of Balloughter, Ballyclough, Ballyeden, Ballygullen, Clonmore, Toberanierin Lower, Toberanierin Upper, Tullabeg and Worlough. Covering three Civil Parishes, all within the Balloughter Electoral Division with the exception of Worlough which is in the Ballymore Electoral Division.

Courtesy of the National Library of Ireland.

Points to Note:

- A Roman Catholic church, graveyard and a school (house) are listed as land owned in Balloughter by the Earl of Courtown. This was well before the new church was built in 1874 and the new school building in 1889.

- The Earl of Courtown was the sole or primary landowner in the townlands of Balloughter, Ballyeden and Tullabeg.

- There is a corn mill listed in Tullabeg. This can be seen on the early OSI maps in the Past/Historical Maps section of the site.

- In Toberanierin, the primary landowner was Solomon A. Richards.

- The graveyard at Toberanierin is listed on the valuations records in Toberanierin Lower while the Tan Yard and forge are listed in Toberanierin Upper.

- In Ballygullen, the landlord was William Drurey. A churning mill is listed in the townland as evident on the OSI maps in the Past/Historical Maps section of the site.

- The landowner in Worlough was Richard Donovan of Ballymore Demesne.

Griffith's Maps for the Ballyoughter Area

If you’re not familiar with interpreting Griffith’s Valuation Maps, please read the article, Griffith’s Valuation Explained’, below so you can analyse the valuations and interpret the maps correctly.

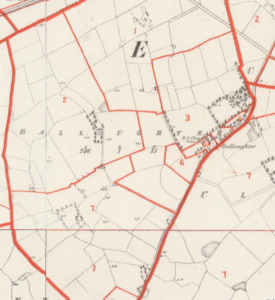

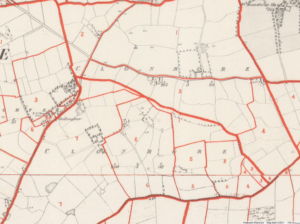

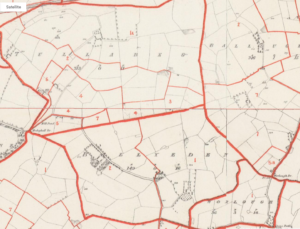

Images of the associated maps for the Griffith’s Valuation at the top of the page.

Courtesy of the National Library of Ireland.

You can view the Interactive Map of the area on the AskAboutIreland website. When the website opens, click on the map view ‘Enlarge’ (+) icon to launch the map. Then zoom in on the mid-point of the lower line in the rectangle to locate Balloughter.

Griffith’s Valuation Explained

What was Griffith’s Valuation?

A property tax survey was conducted in the mid-nineteenth century by Sir Richard Griffith. The survey involved a detailed valuation of every taxable piece of land and property in the country. It was published on a county-by-county basis between 1847 and 1864. The Griffith’s Valuation for County Wexford was published in 1853.

How was it conducted?

The process of valuation was thorough in the extreme. The valuation teams made numerous visits to a landowner and considered multiple factors when determining the economic value of the property and determining the annual income of the property. They conducted soil and geological surveys, reviewed rents paid in the area, took cognisance of the distance from the nearest market town, etc.

How to interpret the records?

On viewing the Griffith’s Valuation records, you will see the “Total Annual Valuation of Rateable Property” in £/s/d (pounds, shillings, and pence) in the far-right column of each valuation record.

The local Poor Law Union decided on the percentage of the “Total Annual Valuation of Rateable Property” to be paid every year and it was usually expressed as “pennies to the pound”. For example, a rate of 5 pennies to the pound resulted in a tax of 50 pence (4s/2d) for a person with property valued as £10.

Based on this valuation, the local Union decided how much was required to run the Union annually and determined a rate that was sufficient to raise that sum of money. These were collected by the rate collectors.

Tenants with a holding valued at less than £5 annually were not required to pay the annual rate. Their landlord was liable for the tax and this liability became an incentive for landlords to get rid of smaller tenants. This, in turn, contributed to an increase in evictions in the late 1800s.

The Area of the lot is recorded in Acres, Roods, Perches (a r p) on Griffith’s Valuation.

- 1 Acre = 43,560 sq.ft.

- 1 Rood = ¼ of an Acre

- 1 Perch = 1⁄40 of a Rood or 1⁄160 of an Acre

How to interpret the maps?

- The numbers and letters listed in Column 1 of the Griffith’s Valuation records refer to the corresponding numbers and letters denoted on the associated Griffith map. This allows you to cross-reference the Valuation of the Land and Buildings owned or leased by the occupier in a particular Townland with the Ordnance Survey map of that same Townland.

- On the map, each Townland boundary is demarcated by a thick red line. The numbered sub-divisions of plots of land are demarcated by lighter red lines.

- The subdivision numbers within a Townland relate to a lot number on the map and correspond to the details associated with the same number in the Griffith Valuation record.

- Capital letters after the subdivision number (e.g., ‘5A, B, C’) are used to label subdivisions within a lot which denote separate pieces of property in the Townland in the name of the same occupier. For example, in Toberanierin Upper, Robert Hill has leased lots at 6A, 6B and 6C from the Landlord, Solomon A. Richards.

- The same capital letter can appear more than once within the same numbered lot when the location of cottagers’ or labourers’ houses is being indicated.

- Lower case letters after the holding number, for example 5a, b and c, signify a single property held in common by several listed occupiers farming a common area.

- Lower-case letters in italic signify built structures, including houses and offices. Where cottagers’ or labourers’ houses are included within the limits of a farm, the farmer’s house is labelled a, while the cottagers’ houses are labelled b, c, etc.